News

Trinityvietnam

Trinityvietnam

16:46 - 17/07/2025

16:46 - 17/07/2025

U.S. Loses Top Spot as Vietnam’s Leading Seafood Import Market Amid Tariff Turmoil

08:26 | July 17, 2025 (Source: vasep.com.vn)

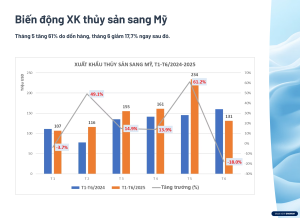

In the first half of 2025, Vietnam’s seafood exports to the U.S. reached USD 905 million, up 17.5% compared to the same period in 2024. This growth was largely driven by a surge in orders during May, as businesses from both countries rushed to finalize transactions ahead of the U.S.’s retaliatory tariff implementation date of July 9, 2025 – a move announced as early as April. However, this short-term surge highlights a broader trend of increasing instability and risk in trade relations, driven by new tariff policies under President Donald Trump’s administration.

Sharp Increase in May, Steep Decline in June

By month, seafood exports to the U.S. showed strong growth in March, April, and especially May 2025 – which saw a 61% year-on-year increase and became the highest-grossing month in H1, with over USD 234 million in exports. However, June witnessed a sharp 18% drop, down to just USD 131 million.

The three key product groups – shrimp, pangasius (tra fish), and tuna – continued to lead exports to the U.S., with a combined value of over USD 700 million, accounting for 77% of the total.

-

Shrimp exports reached USD 341 million, up nearly 13% YoY. In May alone, shrimp exports surged 66%, but plummeted 36.5% in June.

-

Pangasius exports showed more stable growth, totaling USD 175 million, up 10%. After slight declines in March and April, pangasius bounced back strongly in May and continued to rise in June – reflecting steady demand despite market volatility.

-

Tuna exports totaled nearly USD 184 million, up 6.5%. Like shrimp, tuna saw strong growth in May (37.5%) followed by a steep 40% decline in June.

-

Tariff Uncertainty Pushes the U.S. Out of Top Importer Position

Once Vietnam’s largest seafood import market for many years, the U.S. accounted for 17% of Vietnam’s seafood exports in H1 2025. However, it has now lost its top position to China, which imported USD 1.1 billion worth of Vietnamese seafood – a significant 45% YoY increase.

This shift is largely attributed to the U.S.’s increasingly unstable tariff policy. Since April 2025, the Trump administration has repeatedly used retaliatory tariffs as a trade negotiation tool, frequently altering rates, timelines, and affected product categories.

Initially, the tariffs were to take effect from July 9, 2025. But just days before, the deadline was suddenly pushed back to August 1. Moreover, both the tariff rate and the target countries changed continuously – ranging from a global flat rate of 10% to country-specific rates as high as 36% for Thailand and 32% for Indonesia.

Such unpredictability has created an unprecedentedly unstable trade environment, severely disrupting production planning, contract execution, and delivery schedules for both U.S. importers and exporting nations.

American importers have been left “sitting on a powder keg,” unable to forecast import costs, while Vietnamese exporters are struggling to adjust pricing, shipping times, and long-term order planning.

For an industry like seafood, which is highly sensitive to seasonal cycles and logistics costs, this volatility poses significant financial risks, with ripple effects from farming areas to processing, transportation, and payment.

Rethinking Strategy for a New Trade Order

In response to a newly emerging and unpredictable trade landscape, Vietnamese seafood enterprises are left with no option but to restructure their strategies. Key directions being explored include:

-

Market Diversification: Reducing over-reliance on the U.S. and expanding presence in FTA-backed markets like CPTPP, the EU, South Korea, etc.

-

Supply Chain Optimization: Minimizing logistics risks and operational costs.

-

Strict Traceability & Origin Transparency: Strengthening compliance with rules of origin is essential, especially as tariff regulations become increasingly linked with product origin. Companies must ensure that the entire supply chain – from raw materials to processing and export – is well-documented and traceable to prove legitimate origin and avoid allegations of transshipment or tax evasion.

-

Digital Transformation: Leveraging technology such as electronic traceability systems and smart order management to quickly respond to policy and market changes.

-